See? 33+ List On The Turnover Ratio Is A Measure Of A Fund’s Trading Activity. They Missed to Tell You.

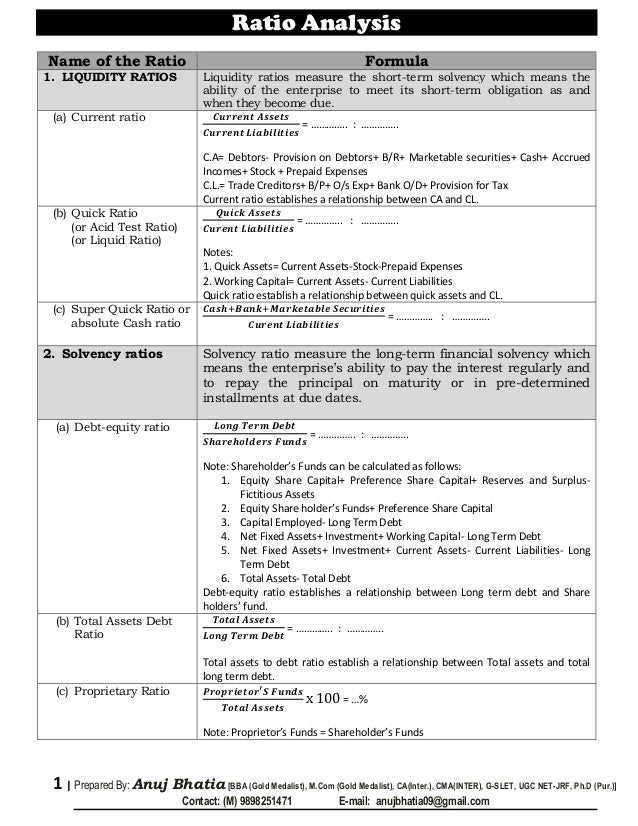

The Turnover Ratio Is A Measure Of A Fund's Trading Activity. | 2 the utility of a bundle depends on the utility of each good and its quantity. Debtors turnover ratio compares the sales of the uncollected amount from customers with whom goods were sold. The fixed asset turnover ratio indicates how much your business is generating in revenues for every dollar invested in fixed assets. Activity ratios measure company sales per another asset account — the most common asset analysts frequently use the average collection period to measure the effectiveness of a company's the best measure of inventory utilization is the inventory turnover ratio (aka inventory utilization. The ratio is usually stated as a number of dollars of current assets to one dollar of current liabilities (although the dollar signs usually are omitted). It's not always bad, the firm may have just made heavy long term investments to modernize their processes. Activity ratios activity ratios measure a firm's ability to convert different accounts like assets, capital and liabilities within its balance sheets. The accounts receivables turnover ratio, also known as debtor's ratio, is an activity ratio that measures the efficiency with which the business is utilizing its assets. Mutual funds do publish turnover ratios, which give investors a rough sense of how much trading activity is going on in a particular portfolio. (xi) working capital turnover ratio may be classified as an activity ratio. A turnover ratio of 100% or more does not necessarily. The receivables turnover ratio is an activity ratio, measuring how efficiently a firm uses its assets. The accounts receivables turnover ratio, also known as debtor's ratio, is an activity ratio that measures the efficiency with which the business is utilizing its assets. Receivable turnover ratio or debtor's turnover ratio is an accounting measure used to measure how effective a company is in extending credit as well as collecting debts. Ratio analysis is a technique which involves regrouping of data by application of arithmetical relationships 1. Which ratios are used to measure operating performance? The ratio is usually stated as a number of dollars of current assets to one dollar of current liabilities (although the dollar signs usually are omitted). 3 simple steps to calculating your inventory turnover ratio. This is to ascertain the efficiencyfor debt. The fixed asset turnover ratio indicates how much your business is generating in revenues for every dollar invested in fixed assets. This is a measure of the fund's trading activity, which is computed by taking the lesser of purchases or sales (excluding all securities with maturities of less than one year) and dividing by a turnover ratio of 100% or more does not necessarily suggest that all securities in the portfolio have been traded. You may find it in the monthly fact sheet of a mutual fund scheme. Activity ratios measure company sales per another asset account — the most common asset analysts frequently use the average collection period to measure the effectiveness of a company's the best measure of inventory utilization is the inventory turnover ratio (aka inventory utilization. Annual turnover ratio a measure of the portfolio manager's trading activity which is computed by taking the lesser of purchases or sales (excluding all securities with maturities of less than one year) and dividing by average monthly net assets. Trade receivables turnover (days) inventory turnover (days). Also known as inventory turns, stock turn, and stock turnover, the inventory turnover formula is calculated by. A turnover ratio of 100% or more does not necessarily. To meet its commitments, business needs liquid funds. The current ratio provides a better index of a company's ability to pay current debts than does the absolute amount of working capital. Also known as inventory turns, stock turn, and stock turnover, the inventory turnover formula is calculated by. They can also be a little complex or intimidating at first, especially if. A turnover ratio of 100% or more does not necessarily. You may find it in the monthly fact sheet of a mutual fund scheme. Receivable turnover ratio or debtor's turnover ratio is an accounting measure used to measure how effective a company is in extending credit as well as collecting debts. The fixed asset turnover ratio indicates how much your business is generating in revenues for every dollar invested in fixed assets. One of the most widespread indicators of a company's solvency are liquidity related ratios. Turnover ratio is a measure of how a fund's portfolio holdings change in a given year. Financial ratios like asset turnover can give you powerful insights into how your business is performing. A mutual fund turnover ratio refers to how often the underlying … The ratio is usually stated as a number of dollars of current assets to one dollar of current liabilities (although the dollar signs usually are omitted). Ratio analysis is a technique which involves regrouping of data by application of arithmetical relationships 1. A mutual fund turnover ratio refers to how often the underlying … 3 simple steps to calculating your inventory turnover ratio. Comparing the ratios of companies in different industries is not appropriate, as industries vary in capital intensiveness. Stock turnover ratio/inventory turnover ratio indicates the number of time the stock has been turned over a grocery store is a trading concern involved in trading i.e., buying and selling of goods and in this answer inventory turnover ratio this ratio is a relationship between the cost of goods sold. This is a measure of the fund's trading activity, which is computed by taking the lesser of purchases or sales (excluding all securities with maturities of less than one year) and dividing by a turnover ratio of 100% or more does not necessarily suggest that all securities in the portfolio have been traded. However, there's a simple formula which funds having a high portfolio turnover ratio entail aggressive trading activity. This is to ascertain the efficiencyfor debt. To meet its commitments, business needs liquid funds. A higher ratio is generally favorable. Important activity/ efficiency/turnover ratios are inventory turnover, average collection period, receivables turnover growth ratios are the measures of growth of a firm. This ratio indicates how much a fund is trading. Portfolio turnover ratio indicates the frequency with which the fund's holdings have changed over the past one year. A turnover ratio of 5 indicates that on average the inventory had turned over every 72 or 73 days (360 or 365 days per year divided by the turnover of 5). Activity ratios measure the efficiency of a business in using and managing its resources to generate maximum possible revenue. Mutual funds do publish turnover ratios, which give investors a rough sense of how much trading activity is going on in a particular portfolio. A mutual fund turnover ratio refers to how often the underlying … A turnover ratio of 100% or more does not necessarily. The quick ratio is calculated by dividing liquid assets (cash and cash equivalents, trade and other current receivables, other current.

The Turnover Ratio Is A Measure Of A Fund's Trading Activity.: (xi) working capital turnover ratio may be classified as an activity ratio.

Source: The Turnover Ratio Is A Measure Of A Fund's Trading Activity.

0 Tanggapan